Despite the current scenario of higher lending rates and limited housing inventory in Canada, there is a persistent desire among Canadians to own a home. Driven by the knowledge that homeownership will help to support a prosperous financial future, many Canadians see the benefits of buying into the housing market as a way to generate additional income and build wealth for future generations. As a result, a significant number of Canadians plan on venturing into real estate investment in the coming years.

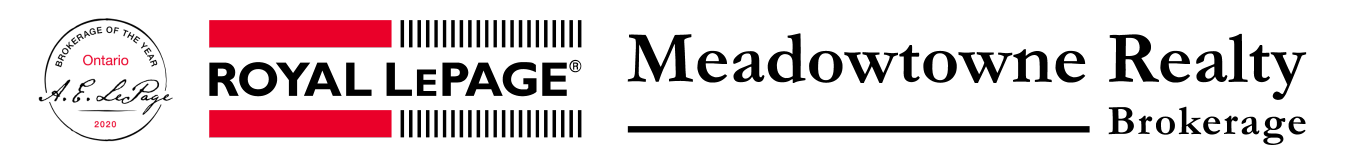

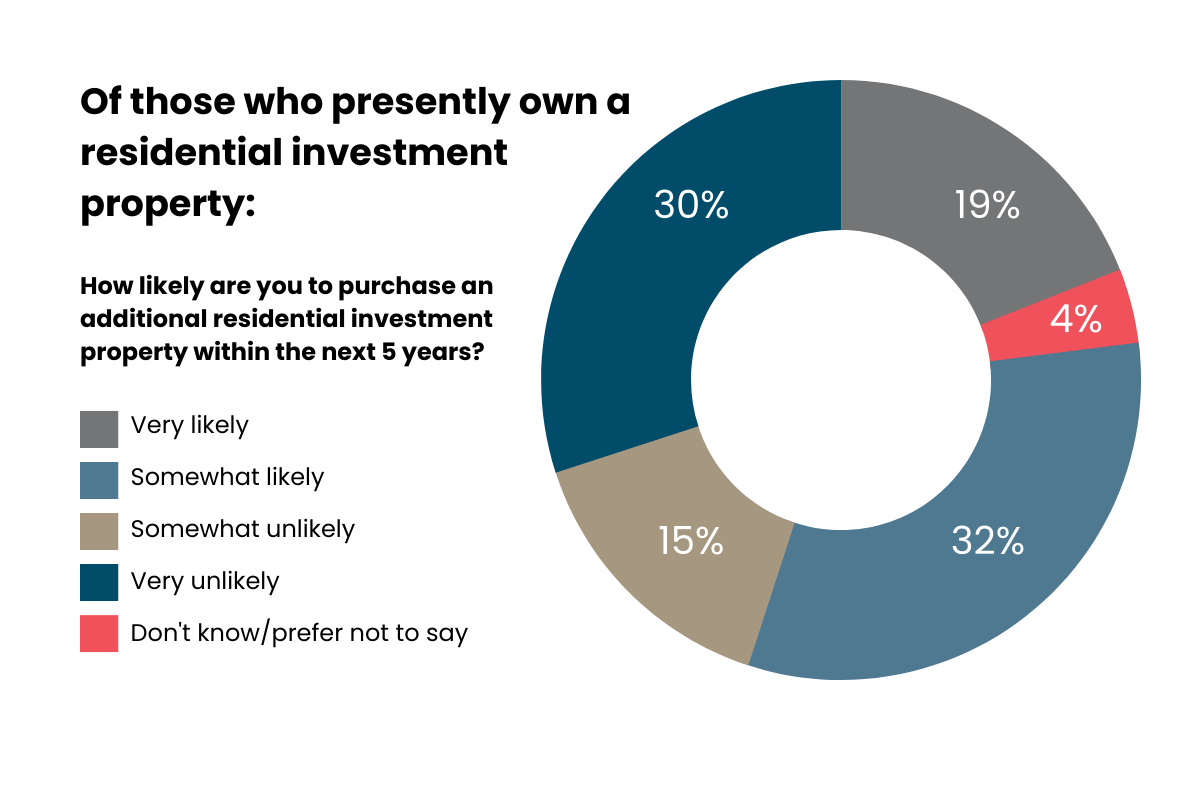

Based on a recent survey conducted by Leger on behalf of Royal LePage, it was found that 23% of non-property owners in Canada expressed their desire to purchase a residential investment property within the next five years. Moreover, more than half (51%) of existing investors revealed their plans to procure an additional residential investment property during the same timeframe. Overall, 26% of Canadians, including both current investors and those who have yet to invest, have set their sights on buying an investment property by 2028.

According to Phil Soper, the president and CEO of Royal LePage, the value of homeownership holds a strong appeal among Canadians. It is evident that owning real estate continues to be a desirable approach to building long-term wealth. Many choose to invest in real estate not only to generate income and benefit from property value appreciation but also to establish a foundation in the market for future generations of their family.

Despite the challenges posed by limited housing supply and rising lending rates, young people are showing an increasing inclination towards including real estate investment in their long-term financial plans. In fact, the survey results indicate that for many of them, investing in property takes priority over owning their primary residence.

The survey also revealed that 15% of Canadian residential investors do not own their primary residence. Among this group, 12% are renting while 3% are living rent-free with family or friends. The majority of these investors fall within the age bracket of 18 to 34, highlighting the growing interest in real estate investment among the younger demographic.

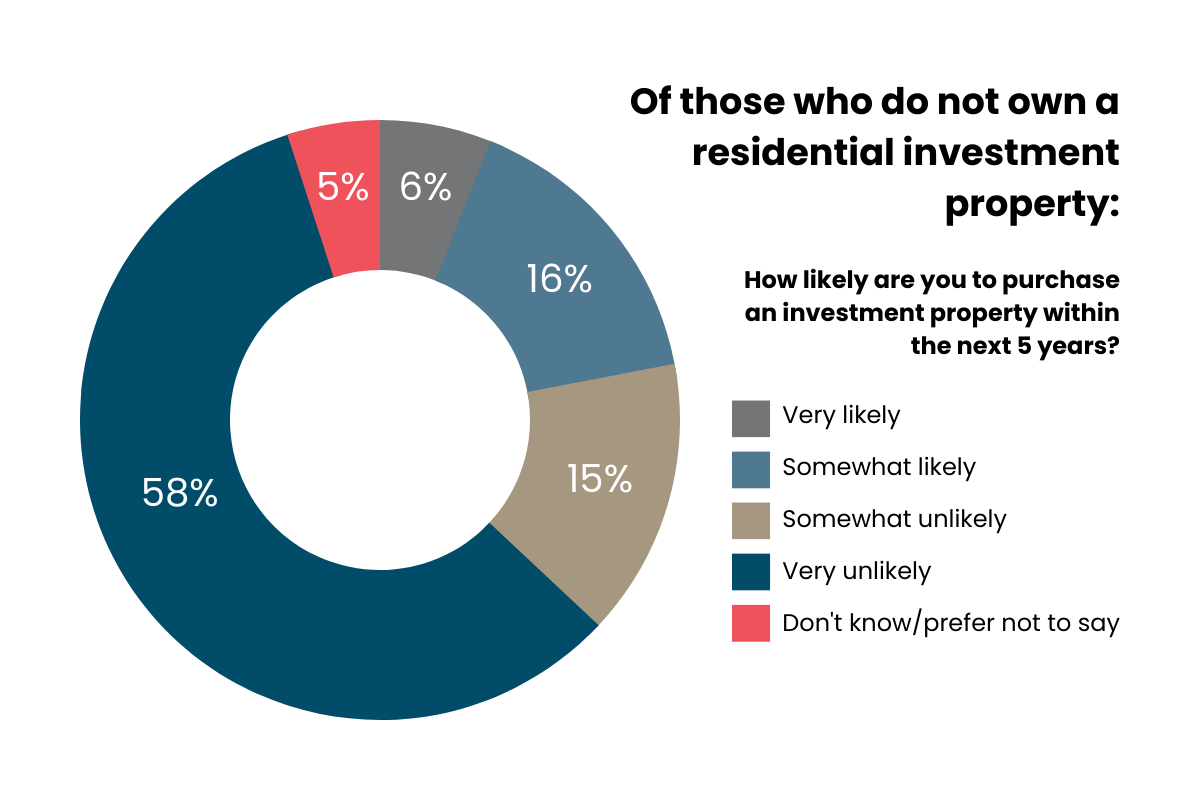

The growing cost of borrowing, particularly with variable-rate mortgages, has had a notable impact on Canadian investors and their investment properties in the past year. The rise in lending rates has led to about 31% of investors examining the sale of one or more of their properties. Among investors aged 18 to 34, a significant 54% are considering the decision to sell at least one investment property.

Phil Soper remarked on this situation, stating, “Higher mortgage rates and the increased costs associated with home maintenance and utilities have prompted some investors who are over-leveraged to consider selling.” However, initial concerns that the investor segment would face a significant downturn during the pandemic were alleviated. While pre-construction projects were delayed and downtown condos experienced vacancies, resulting in landlords reducing rental rates, the situation quickly changed as the pandemic was contained. With housing shortages prevailing across Canada, residents swiftly returned to urban centers. Not only did rental rates rebound, but they also rose substantially, indicating that the downturn in the sector was temporary.

The Royal LePage® 2023 Real Estate Investors Report highlights several key points:

– Approximately 11% of Canadians, which translates to around 4.4 million individuals, presently own an investment property.

– Nearly one-third (31%) of investors in Canada have contemplated selling one or more of their investment properties due to the higher lending rates.

– In the Greater Montreal Area, 20% of investors expressed their likelihood of selling one or more investment properties within the next two years. This expands to 24% and 28% in the greater regions of Toronto and Vancouver, respectively.

All in all, the allure of real estate investment continues to captivate Canadians despite challenges around higher lending rates and limited housing supply. The enduring appeal of homeownership and its promise of a secure financial future is driving a remarkable number of Canadians toward real estate investment. Even with the initial impact of increased borrowing costs prompting some investors to contemplate selling, the Canadian real estate market has demonstrated resilience, reassuring Canadians that property investment remains a viable and profitable long-term wealth strategy. With a younger demographic notably eager to engage in property investment, it is clear that real estate as a wealth-building tool will continue to flourish in Canada for years to come.