Navigating Determined Homebuyers and Cautious Sellers Amidst Interest Rate Hikes: Insights from Royal LePage® Canada

In light of the Bank of Canada’s rate hike this week, Royal LePage® Canada issued a press release1 stating that despite the possibility of further interest rate hikes, homebuyers maintain their unwavering determination to acquire property, while sellers approach the market with increased caution. Despite the persistent scarcity of available housing, partly caused by sellers hesitating to list their properties, the strong demand from buyers will continue to persistently drive-up home prices, particularly during the fourth quarter of this year.

“Economic uncertainty has caused some potential sellers to reevaluate their plans… The worry that they will be unable to find the move-up home they need in today’s tight market is a major concern. Further, there are those who secured fixed-rate mortgages at generational lows… who are understandably reluctant to wade back into a market with substantially higher borrowing costs.”

President and CEO of Royal LePage® Canada, Phil Soper.

With a decrease in the number of sellers and listings, it is natural for the market to face some pressure. Nevertheless, as indicated by the Royal LePage® 2023 Canadian First-Time Homebuyer Survey2, there is still a robust demand from prospective homebuyers. “Buyers who are determined to make a purchase this year have accepted the reality of higher initial carrying costs, rationally surmising that rates are at or near peak and will become more affordable before long,” said Soper3.

Home buyers across Canada may be looking to more affordable regions than they had originally planned, but they remain determined regardless of the central bank’s decision to increase their lending rates4. Adjusting expectations, widening geographical searches, and acquiring property that may be smaller than anticipated, all combine to help would-be home buyers find success in today’s markets.

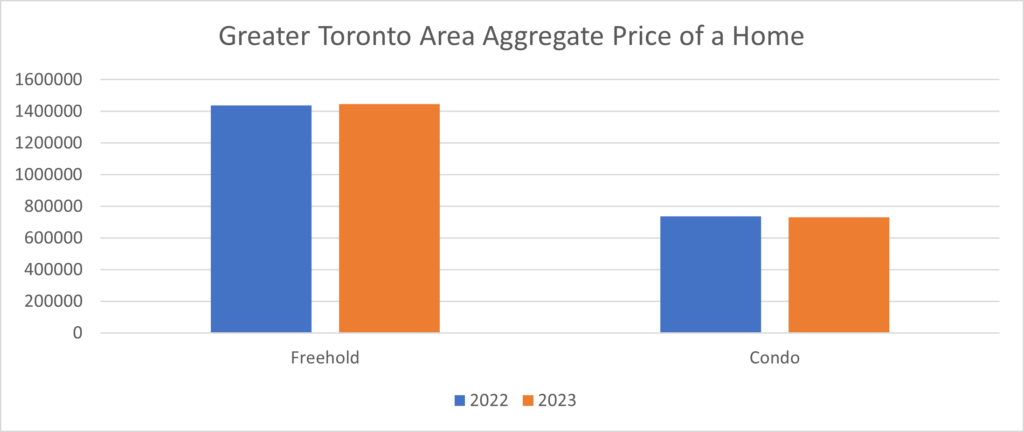

In the second quarter of 2023, the Greater Toronto Area’s aggregate price of a home increased year-over-year to $1,180,400. Where aggregate prices are calculated by using a weighted average of the median values of all housing types in the GTA5. Upon analyzing the housing types individually, it becomes apparent that the median price of a single-family detached home experienced a 0.7% increase year-over-year to $1,447,600, whereas the median price of a condominium declined by 1% to $731,100 during the same period.

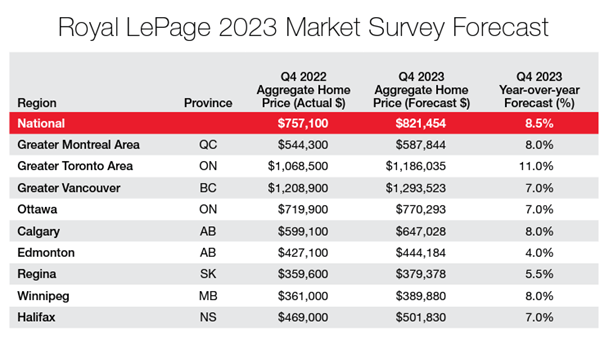

Accordingly, the Royal LePage® Forecast Chart 7 has also been revised to reflect the unwavering demand we’ve seen from home buyers this year. Royal LePage® forecasts that the aggregate price of a home in the GTA will increase by 11% by the end of 2023, the highest increase across Canadian markets.

Overall, despite the interest rate hikes implemented by the Bank of Canada, it is evident that home buyers maintain their resolve to achieve their homeownership goals. While sellers exhibit increased caution, their concerns may not be entirely warranted. The strong and ongoing demand in the housing market will continue to drive significant price growth throughout the Greater Toronto Area (GTA).

Sources:

1 GTA homebuyers face mounting competition as supply levels remain low in the second quarter

https://docs.rlpnetwork.com/HousePriceSurvey/RegionalUpdates/2023/Q2/GTA_HPS_Q2_2023.pdf

2 Royal LePage® First Time Home Buyer Survey

www.royallepage.ca/en/realestate/news/down-payment-dilemma-canadian-first-time-homebuyers-fear-of-falling-short-is-escalating/

3 Homebuyers remain determined while sellers step back in response to additional interest rate hikes: Royal LePage

www.royallepage.ca/en/realestate/news/homebuyers-remain-determined-while-sellers-step-back-in-response-to-additional-interest-rate-hikes-royal-lepage/

4 Bank of Canada, July 12, 2023

www.bankofcanada.ca/2023/07/fad-press-release-2023-07-12/

5 Data is provided by RPS Real Property Solutions and includes both resale and new builds.

6 Royal LePage® House Price Survey Chart

marketing.rlpnetwork.com/Communications/Royal_LePage_National_House_Price_Composite_in_the_Second_Quarter_of_2023.pdf

7 Royal LePage® Forecast Chart

marketing.rlpnetwork.com/Communications/Royal_LePage_Q2_2023_Market_Survey_Forecast.pdf